For 20 years, China has been the fastest growing market in the global automotive industry. After 2000, the sales volume of cars, commercial vehicles, automobile DVDs and Android on-board GPS increased by about 10 times, with the annual sales volume exceeding 20 million units, with a compound annual growth rate of about 20%.

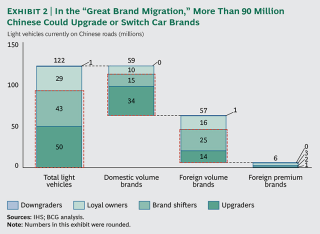

At present, this golden age of super rapid growth is coming to an end, and the huge Chinese automobile market is entering a new core stage. Domestic and foreign automobile manufacturers should not only ensure first-time buyers, but also ensure the loyalty of existing customers. According to the Center for Consumer and Customer Insight in China of The Boston Consulting Group, at least three quarters of Chinese car owners plan to change their brands when buying the next car or installing Android car stereos. We call these upcoming changes “changes”. Great brand migration. ”

The customer has different reasons for being disloyal. Among China’s increasingly affluent consumers, many are now able to purchase higher quality or more famous brands. But millions of people are trying to move from the same segment of the market to other car brands. Why? When many of these consumers bought a car with a car dvd player for the first time, they basically chose a brand they were familiar with. But now they know their choice better. Many Chinese drivers are dissatisfied with all aspects of their cars.

BCG’s survey of 2400 Chinese car owners shows that Chinese drivers are more eager to change their brands than ordinary consumers in developed economies. In addition, from the owners of basic domestic models to those who buy expensive luxury cars and General Motors(GM) navigation, this sentiment echoes among the owners of various market segments.

Some research results show that the next war in China’s automobile market will be centered on customer loyalty. To be sure, in the remaining 10 years, China is still one of the most popular markets for the first car buyers in the world. However, success in China will increasingly depend on the ability of automobile manufacturers to maintain existing customers and keep customers away from competitors. For companies with a full range of price point car brand portfolio, the ultimate goal is to build enough loyalty to win customers, and seize them when they switch from low-cost cars to high-end cars, rather than catching such customers again and again.

For a few auto manufacturers who enjoy rock solid reputation and consumer loyalty in China, the great brand transfer of Android Auto GPS is a huge opportunity to increase its share in the growing market. But most other auto companies must greatly improve their game level in order to win the increasingly fierce battle for loyalty.

Domestic brands are under special pressure because the market share of many brands in China has been declining. Considering China’s fierce price competition for economical cars, they must improve their reputation for quality and performance, which is an arduous task. But even multinationals cannot take their success for granted. With the appearance of attractive substitutes, the advantages enjoyed by foreign brands among Chinese consumers who buy cars for the first time begin to disappear. As car buyers, Chinese consumers are becoming more and more mature. They clearly expect better quality, service, performance, car dvd players and android car audio. For auto companies that meet consumers’ expectations and accurately position their brands, they have won great awards in China.